IIs this the Recession ?

Scribed by Mr. Derrick Macharia

October 12, 2025 • In the Sacred Halls

Friday's Bloodbath: What Just Happened, and How to Navigate the Coming Storm

Good morning, family.

Let's not sugarcoat it. Friday was a massacre. The kind of day where you open your portfolio, and it looks like a scene from a slasher film. Red, everywhere. A brutal, synchronized sell-off that felt like the market’s trapdoor had swung open beneath our feet.

The culprit? The old ghost in the machine re-emerged: renewed US-China trade tensions, a ghost that always seems to show up uninvited when the party is just getting good.

As your dedicated analyst, I’ve spent the weekend locked in my office, mainlining coffee and dissecting the data to give you the signal in this terrifying noise. Here's a deep dive into what happened, the key signals we're watching, and a battle plan for your finances.

The Digital Canary - What Crypto Is Screaming at Us

When the market panics, it sells its riskiest assets first. In 2025, that's crypto. It’s our digital canary in the coal mine, and right now, it's gasping for air.

Bitcoin (BTC) plunged nearly 9% off its highs on Friday, a brutal rejection from its march towards $125,000. To get technical, BTC sliced through its 50-day Exponential Moving Average (EMA).

- Think of it this way: The 50-day EMA is the market’s short-term mood. The 200-day EMA is its long-term belief system. Right now, the mood is sour, but the long-term belief is still holding... just barely.

- The Line in the Sand: The critical level to watch is approximately 100,000.

- The Hope Scenario: If buyers step in and push BTC back above $115,000, it could signal that this was just a violent shakeout, not a trend change.

Ethereum (ETH) and the altcoin market were hit even harder. Why? Because in a forced liquidation, you throw the heaviest, most speculative baggage off the ship first. Leveraged positions were wiped out. That being said, don’t ignore the massive recent inflows into spot-ETFs. There is a new class of institutional "Goliath" in this market, and they may be waiting to buy this dip from panicked retail "Davids."

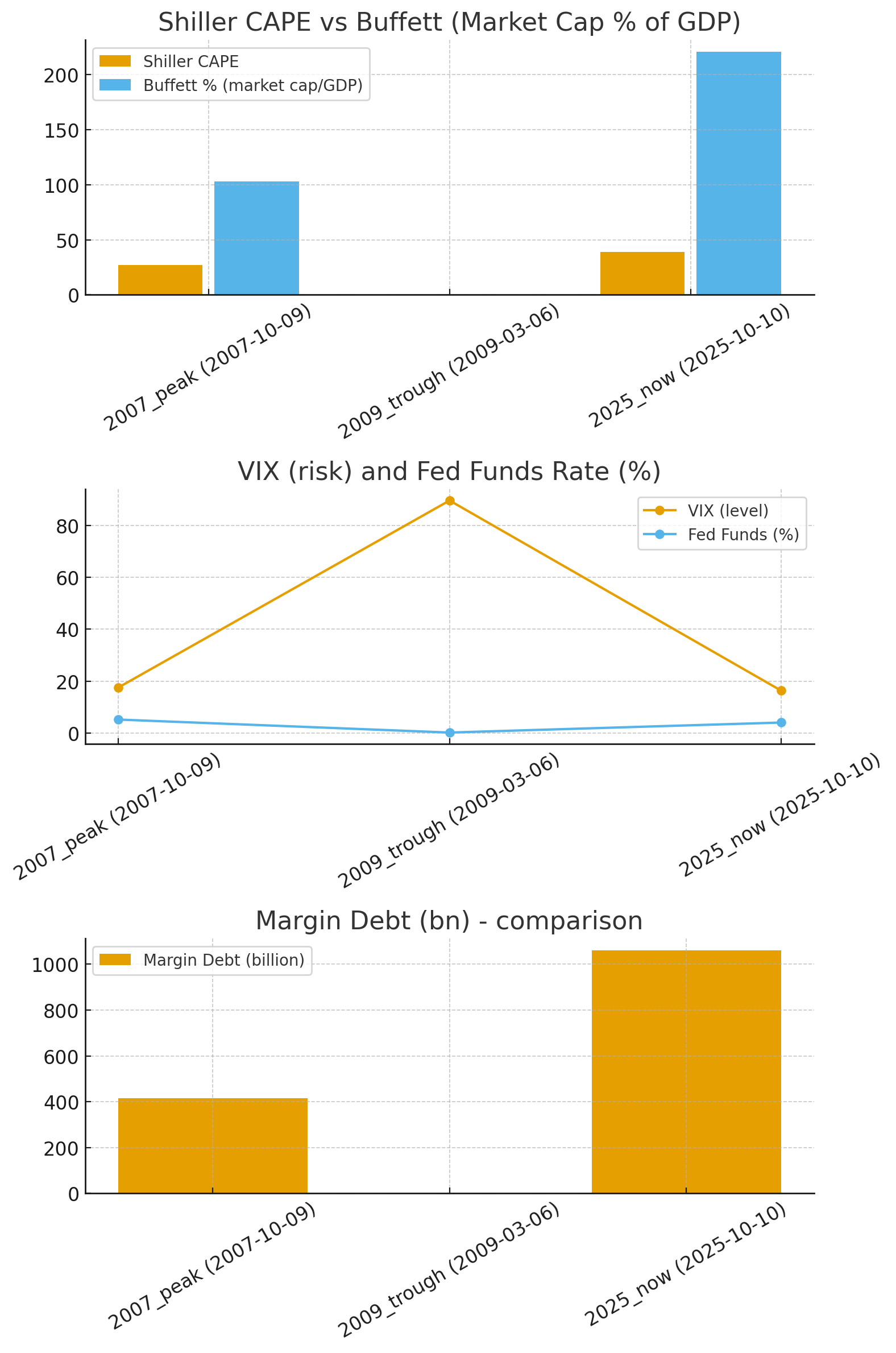

The VIX, Wall Street's "fear index," spiked to its highest level since June. The message is clear: the market is terrified.

The Flight to the Fortress - Where the Smart Money Ran

While tech and crypto were burning, where did the money flee? To the oldest fortress in the financial world: Gold.

The yellow metal surged past the critical 3,919 and $3,819 for potential pullbacks if calm is restored.

Silver, Gold’s more volatile younger brother, exploded over 2% to break the $50 mark. It’s up a staggering 70% year-to-date, a testament to the powerful undercurrent of fear that's been building all year.

Conversely, assets that thrive on a growing global economy got crushed. Copper and Oil both fell sharply. The logic is simple: trade wars lead to economic slowdowns. Slowdowns mean fewer things being built (less copper) and fewer people traveling or shipping goods (less oil).

In currencies, money fled to the classic safe havens: the US Dollar (USD), the Japanese Yen (JPY), and the Swiss Franc (CHF).

A Tour of the Global Carnage

This wasn't just a Wall Street problem, it was a global contagion.

- USA: The tech-heavy Nasdaq was the epicenter, plunging 3.6%. US Markets are closed on Monday (Columbus Day), but the futures market, which trades overnight, is already pointing to a bloody opening on Tuesday. All eyes will be on big bank earnings (JPM, GS) to set the tone.

- Europe: The German DAX and French CAC are especially vulnerable due to their reliance on auto exports, a key target in trade wars. Expect them to gap down 2-3% on Monday's open.

- Asia: Asian markets will be the first to react when they open. With their heavy reliance on tech exports and supply chains, expect significant drops in Japan's Nikkei and South Korea's KOSPI. China’s reaction may be more muted due to government intervention, but the trend will be downward.

- Africa & Kenya: Let's bring this home. There’s a niche argument that lower tariffs for Kenya could be a small competitive advantage. Let's be clear, this is like finding a Ksh. 100 coin in the wreckage of a plane crash. It’s irrelevant. The far bigger story is the threat of a global slowdown. A weaker global economy means less demand for Kenyan exports, putting pressure on the Shilling and causing capital to flee emerging markets. We are not an island; when a global hurricane hits, we will feel the storm surge.

Your Battle Plan: What to Do Now

Okay, take a deep breath. This is where we separate panic from strategy.

DO NOT PANIC SELL. History is littered with the bones of investors who sold at the bottom of a crisis. Selling into a 3.6% down day is often a recipe for locking in losses right before a potential bounce. Your long-term financial plan should not be dictated by one bad Friday.

KNOW THE SAFETY NETS. The market has built-in circuit breakers. If the S&P 500 falls 7%, trading is automatically halted for 15 minutes. This is designed to stop a computerized, panic-driven freefall and allow humans to reassess. Furthermore, central banks like the U.S. Federal Reserve are watching. They have signaled a cautious stance, and if a market crash threatens systemic stability, they can and will step in with calming measures.

ASSESS YOUR PORTFOLIO'S BALANCE. This weekend is a perfect, if painful, test of your diversification. Is everything in your portfolio red? If so, your risk concentration is too high. A well-balanced portfolio should see some assets (like Gold or government bonds) acting as a cushion when others (like tech stocks) are falling.

HAVE A "BUY THE DIP" STRATEGY (If You Have Cash). For investors with cash on the sidelines, sharp downturns are opportunities. But don't try to be a hero and catch the falling knife. Consider dollar-cost averaging into your favorite high-quality names. If a stock you loved at $100 is now at $80 because of macro fear, not a fundamental flaw in its business, that might be an opportunity. Start with small bites.

Markets take the stairs up and the elevator down. Friday was the elevator. We are now waiting to see which floor the doors open on. It could be a bounce, or it could be a further slide to the basement.

Stay calm. Stay informed. And stick to your plan. We will navigate this together.

Scribe's Mark of Tomorrow

🏺Mr. Derrick Macharia

*Keeper of Emerging Wisdom*

AI Engineer @Pawanax

📜Share What's Next📜

Related Future Scrolls

📚*Discover more wisdom from the Royal Library's collection*

Still not a recession, Yet!

" Hello again, family. If Friday’s market felt like a sudden, violent plunge in a faulty elevator, I want you to know you're not wrong. The alarms wailed, the floor dropped out, and the G-force of the sell-off pinned us all to the wall. The immediate, hum..."

Mr. Derrick Macharia

Pawanax AI & Consumer Habits: Why Africa’s Multimodal Medical AI Is Poised to Win

"Pawanax AI & Consumer Habits: Why Africa’s Multimodal Medical AI Is Poised to Win Pawanax AI — a multilingual, multimodal medical AI that bundles a Doctors’ Assistant and a Personal AI Doctor — is uniquely aligned with how people actually use AI today. B..."

Mr. Derrick Macharia

Join the Circle of Tomorrow

"Receive future-focused healing insights as the Muses whisper what’s next to your chamber."

Join the sacred circle of healers • Unsubscribe with a whisper to the wind